seventh Top Financial makes it much simpler so you can be eligible for 100%, No money Off USDA mortgage applications in New jersey, Nyc, Pennsylvania, Virginia, Maryland, Tx, Fl, Colorado and you can Kansas!

USDA Rural Innovation home loan money are specially built to assist reasonable so you’re able to moderate money properties and you will first time home buyers purchase home inside the USDA qualified outlying portion. seventh Peak Mortgage now offers USDA mortgage programs which can be used to find a current house, generate an alternative family away from scrape, otherwise create solutions otherwise renovations to an existing USDA eligible rural assets. This type of funds can also be used to improve water and you may sewage assistance on your own rural property, if you don’t always move around in a house altogether. USDA home loan programs come in the state 7th Height Home loan is actually subscribed to do home loan credit as well as Nj-new jersey, Nyc, Pennsylvania, Virginia, Maryland, Texas, Fl, Texas and you may Kansas. Standard loans Flomaton qualifications advice to the program are exactly the same during the every state, but not for every condition considering income and inhabitants occurrence. Luckily that if you seek a home home mortgage off seventh Height Mortgage in one possibly Nj-new jersey, Ny, Pennsylvania, Virginia, Maryland, Colorado, Fl, Tx and you will Kansas extremely areas during these states meet the requirements!

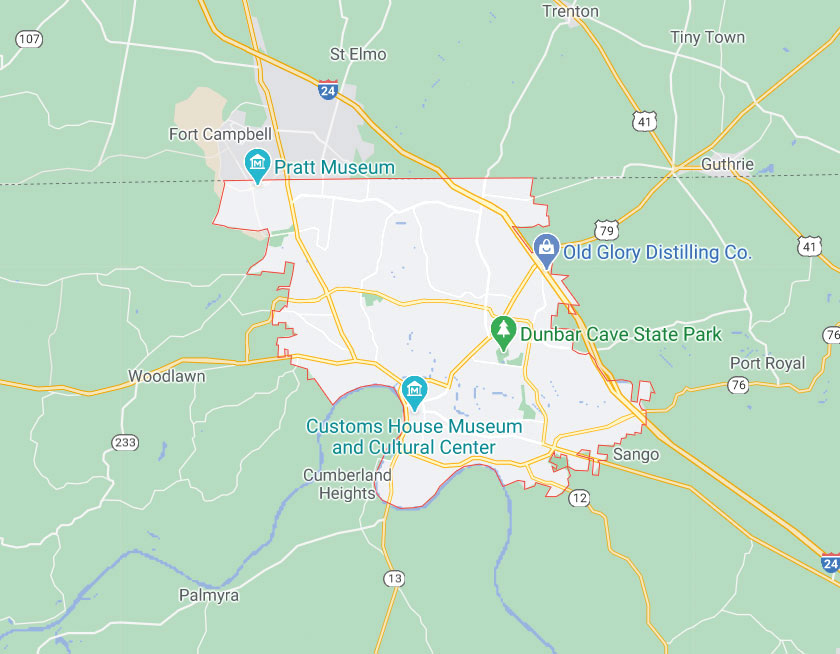

USDA Qualified Elements

If you are selecting a beneficial USDA household, the next thing is to ascertain whether the household your own looking to purchase is currently from inside the an effective USDA qualified town. USDA qualified parts start from state to state as they are calculated considering several different products. Getting an area is USDA eligible it should be discover in an outlying urban area. The fresh USDA talks of an outlying urban area once the any area that’s outlying in nature and that is perhaps not section of otherwise associated with a city, or any urban area, village or town and has now less than ten,000 citizens. Other smaller outlying areas outside of major population centers which have an excellent significant diminished mortgage borrowing could possibly get meet the requirements with populations ranging from 10,000-20,000 residents. Many of these parts might not additionally be outlying in general, but i have communities out-of lower than 20,000 and are also perhaps not from the one big town otherwise cities.

USDA Income Constraints

As USDA rural mortgage brokers was designed just for reduced in order to modest money houses, there are particular earnings restrictions in place in check be considered. So you can qualify for a great USDA mortgage, your general annual family money should not surpass 115% of your mediocre average money for the types of town. According to where you are choosing to buy your home, money restrictions can be large or all the way down according to that certain area’s average average income. Such as for instance, when you find yourself choosing to pick a great USDA eligible possessions when you look at the Brand new Jersey the cash maximum is in fact across the board set on $91,five-hundred. For a whole range of USDA eligible counties, as well as their earnings limitations you can visit it hook or contact our financing representatives here at 7th Height Mortgage.

Because possible customer provides discover an effective USDA eligible assets, the house or property need to fulfill certain USDA loan conditions, generally such requisite are exactly the same for everybody authorities insured money. Most of the features must be small in the wild and you may satisfy every developed requirements implemented by Condition and you may local governing bodies.

Overall, seventh Top Mortgage will help one debtor that have credit ratings of 620 or most useful qualify for a great USDA mortgage within the The newest Jersey, Nyc, Pennsylvania, Virginia, Maryland, Colorado, Florida, Colorado and Ohio. When you have a good credit score having slight credit blips here and you will here we could possibly be able to get you accredited, everything you need to create was contact a representatives or complete the contact form less than in order to find out.

USDA Financing Re-finance Choice

When you have already acquired a great deal towards the an effective USDA mortgage, you’re surprised to know that you should buy an amount better contract for the a good USDA refinance loan. USDA re-finance loans are only entitled to current USDA financing and you may are generally simple and fast with no possessions review. There are lots of some other refinance loans readily available together with improve and non-streamline refinance loans, which includes financing requiring zero family appraisal while some permitting you to invest in your own settlement costs toward overall dominating of your own loan. Plus one of the greatest pieces regarding USDA refinance loans is that they ensure your USDA mortgage will result in a great down monthly mortgage repayment than you’re using now.

Note: Of the submission your request, your grant consent to own seventh Top Home loan to make contact with your by email otherwise by mobile.