Understanding the USDA loan acceptance process

Just after an unclear mortgage program, USDA fund are in fact appealing to home buyers just who possess moved which have an enthusiastic FHA financing.

While FHA needs step three.5% down, USDA demands zero deposit whatsoever – and you may home loan insurance policy is less and you can rates tend to all the way down.

But the majority of home buyers ponder in regards to the USDA loan procedure action by the action and exactly how the brand new USDA loan timeline compares.

Exactly how a beneficial USDA mortgage performs

USDA lenders try supported by the us Department from Agriculture (hence title) to promote monetary growth in rural regions of brand new You.S.

However, getting so it secured mortgage does not mean you must lookup aside an authorities work environment to apply. Loan providers inside the nation was supported because of the USDA to help you accept such fund.

Whenever you can rating an enthusiastic FHA loan otherwise traditional investment within a specific lender, odds are it has got USDA as well.

USDA financing procedure schedule: Detail by detail

Qualifying having a USDA home loan is like any other type out-of mortgage, except having an additional action: Your loan app must be approved by the USDA.

- Get a hold http://elitecashadvance.com/installment-loans-mo/denver/ of and prequalify which have an excellent USDA-acknowledged bank

- Apply for preapproval

- Find a property inside a qualified rural area

- Build an offer

- Go through the underwriting process

- Close on your new house financing

Step one: USDA lending company prequalification

Not absolutely all mortgage company participate in the fresh USDA loan program. And you will borrowers taking time for you find one one specializes in USDA mortgage loans will definitely discover the possibilities helpful, particularly within the underwriting and recognition processes.

When you prequalify to possess a USDA financial, their bank offers a general guess of exactly how much you could acquire and though your see qualifications standards.

Your loan officer will most likely would like to know their desired amount borrowed, monthly income, and you may month-to-month bills. They could in addition to remove your credit rating at this very early prequalification phase, also.

Credit score

Your credit rating try a choosing cause of determining the interest price on your own financing – the greater your credit score, the better your interest rate, and the decrease your mortgage repayments.

Therefore if improving your credit score can save you money on the loan’s monthly payments, then prequalification offers time for you boost their borrowing from the bank.

While there is zero authoritative lowest credit needs so you can be eligible for an excellent USDA financial, very approved lenders require a FICO get regarding within least 640.

When your bank has affirmed qualification, you are install for another help USDA financing recognition processes timeline: preapproval.

2: USDA mortgage preapproval

Next step up the USDA loan schedule was an excellent preapproval. Preapproval was a far more rigorous study of your bank account when your lender should determine your debt-to-money proportion (DTI) and you may be sure simply how much you might borrow on the acquisition price of an alternative household.

- W-dos models, 1099 forms, and tax statements

- Shell out stubs

- Bank statements and asset statements

- Personal security count, pictures ID, and other very first monetary info

Providing preapproved for a loan was a critical action before you can attend open property and wade household hunting. Extremely providers and real estate professionals wish to know these include dealing that have a significant client having a loan provider preapproval letter in the-hands.

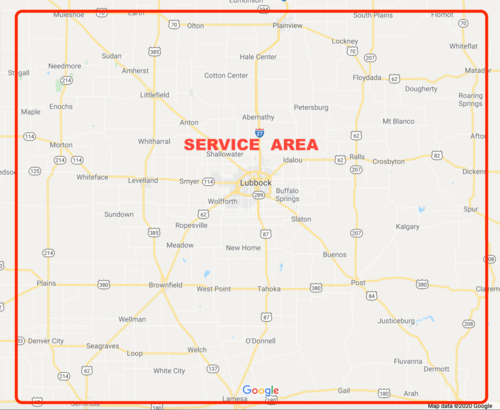

Step 3: Find a home in a qualified urban area

Since identity by itself suggests, this new USDA outlying invention loan encourages homeownership for the qualified outlying parts for both very first-day home buyers and you can mainly based borrowers equivalent.

USDA property eligibility criteria

Yet ,, of several first-day home buyers are shocked observe how many house are eligible. An estimated 97% of the U.S. residential property size is known as outlying of the USDA.