Case of bankruptcy can be force possible home owners to alter their arrangements, it doesn’t always have in order to-specifically for veterans and you can effective obligation staff.

cuatro Tips on Virtual assistant Lenders and you will Bankruptcy

- Tips Be considered Immediately after a chapter 13 Bankruptcy

- How to Meet the requirements Just after a part 7 Bankruptcy proceeding

- Ways to Alter your Credit score

- Ideas on how to Qualify Shortly after a foreclosures

Va money when it comes to a mortgage was given by the new Agency away from Veteran’s Items, nevertheless home loan in itself originates from a private home loan company or an organization bank. But not, an effective Virtual assistant mortgage differs from a conventional loan in several ways. In the place of a conventional financing, a beneficial Va mortgage was supported by the government. If your Virtual assistant debtor defaults into the loan, the government tend to compensate the mortgage financial getting an element of the amount borrowed. Thus a lender otherwise mortgage servicer confronts smaller risk in the stretching a mortgage to help you an effective Va consumer. They could render experts and you will provider users to your best possible terms off month-to-month homeloan payment quantity, the rate, additionally the resource fee.

Va mortgage brokers are like USDA funds and FHA funds, although latter a few is targeted at homebuyers of minimal economic function. Although Va funds are not particularly intended to promote property for a borrower that have faster money, they are designed to offer much easier financing acceptance to own army pros and you may energetic obligations team in exchange for the support rendered to have the nation.

What’s Personal bankruptcy?

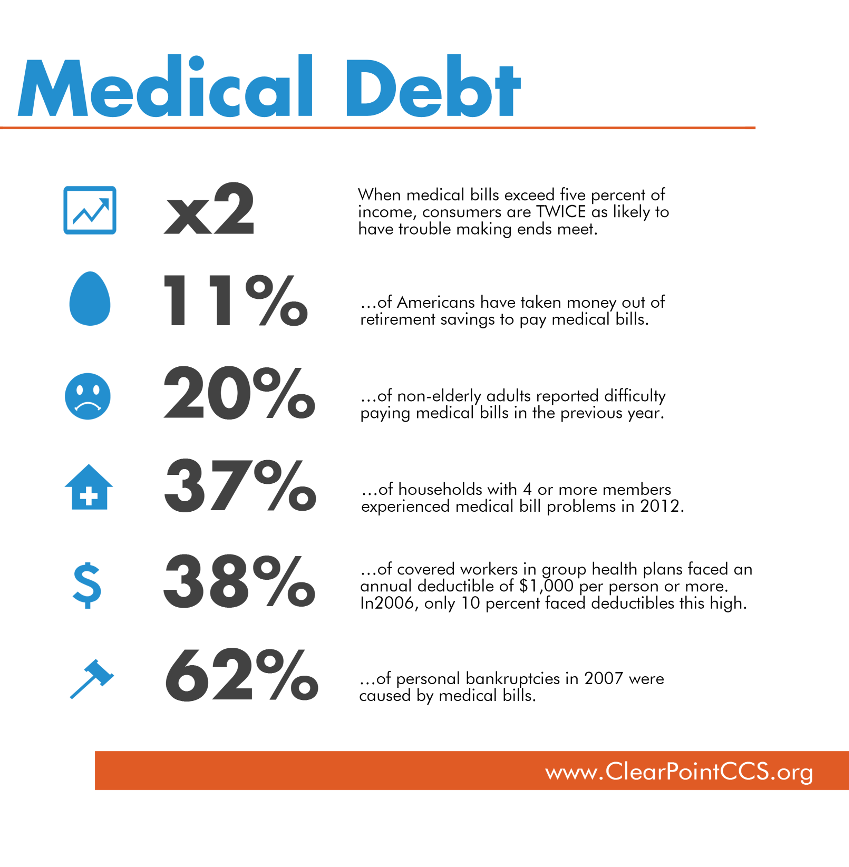

Case of bankruptcy is actually an appropriate techniques one could experience to find rest from expenses they can not repay. No matter if these costs are from a variety of provide, the most famous serious events and continuing crises that can cause personal bankruptcy is actually scientific expenses, layoff, terrible use of borrowing from the bank, and you can separation and divorce.

You will find different types of personal bankruptcy, however, pursuing the personal bankruptcy process could have been finished, the person(s) who submitted having bankruptcy proceeding gets the expense released, with exclusions for example expense for loans acquired around incorrect pretenses or away from fees, online installment loans Kansas student loans, alimony, and youngster help.

Although not, charge card bills, mortgage brokers, and you will auto loans are a few personal debt brands and that’s cleaned out, except if an individual should choose in order to reaffirm some of their debt-something which unscrupulous financial institutions will get make an effort to trick brand new filer toward creating. In a number of sort of bankruptcy, a bankruptcy trustee will assist the fresh filer workout an installment plan so they are able retain their possessions. As a result of its end, the remaining personal debt will be forgiven or discharged.

Immediately following these types of expenses have been released, anyone just who recorded to have personal bankruptcy can begin to repair their funds in addition to their credit score. It needs regarding the step 1-3 years in advance of somebody who has submitted to possess case of bankruptcy commonly qualify for a much bigger version of personal debt like a home loan. Before this, a credit file from one credit bureau will show the bankruptcy proceeding submitting in their previous record, in addition they may not have yet shown so you can prospective loan providers that he has the brand new economic solvency to take on the burden out of a monthly payment for a home.

Must i Score a beneficial Va Financial Once Personal bankruptcy?

You can now get a mortgage shortly after personal bankruptcy, bringing he’s enhanced its credit score, enhanced their using habits, and can display economic solvency. They essentially requires between you to three years before an enthusiastic organization lender such a financial might possibly be safe giving instance a great person a large financing for example a home loan. But the very good news would be the fact it’s even easier to possess good experienced otherwise productive obligations services associate so you can safer a home loan once personal bankruptcy just like the bounce-back going back to a great Va financing was quicker.