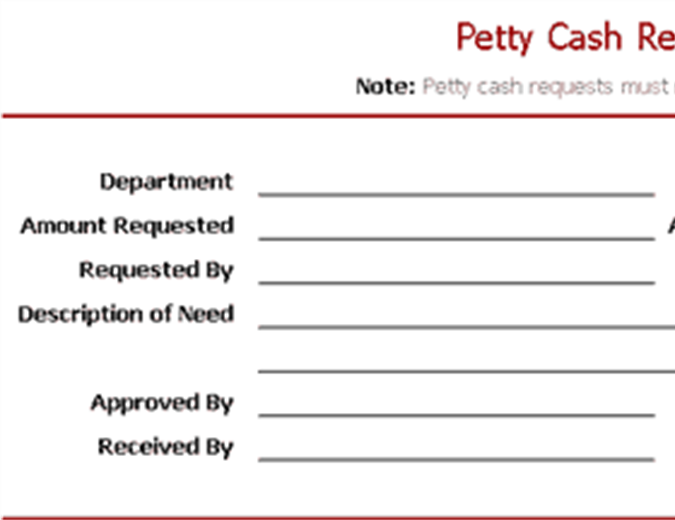

- a good $3 hundred,000 5-year fixed label financial, amortized over 25 years

- a good $100,000 HELOC having attention-merely repayments

As consumer pays down the an excellent dominating on the $300,000 identity home loan, the newest readvanceable home loan try rebalanced, doing much more offered HELOC credit.

- repaired speed mortgage

- changeable speed financial

- mixed name or rates

- enhanced credit limit for the HELOC

- line of credit

- organization credit line

- bank card(s)

cuatro.step 1. Over-borrowing

Given that challenging majority of users keep its HELOC in the a beneficial reputation, many are this by making minimal percentage (we.elizabeth., interest-just payments) otherwise and work out just occasional jobs to minimize the main. Studies have shown one approximately 4 inside 10 customers do not create a typical payment against its a great HELOC prominent, and 1 in 4 just safeguards the eye or make minimum commission. Footnote several

HELOC consumers will find by themselves inside good home collateral removal obligations spiral, instance during the episodes from financial stress. Certain loan providers sector HELOCs due to the fact a supply of disaster finance you to definitely can be used to safeguards unforeseen costs or a loss in income. When customers borrow secured on their house security and work out concludes see, it run the risk of obtaining to recoup far more equity down the road in order to protection the minimum money on the HELOC. Which pattern of behaviour may lead customers to increase their debt burden while in the symptoms regarding monetary stress rather than reining inside discretionary expenses.

4.2. Financial obligation time and effort

This new evergreen nature out-of HELOCs will get promote financial obligation persistence. HELOCs are produced, and frequently ended up selling, since the financial products that allow consumers to borrow huge amounts out of money against their house collateral, with little to no if any obligations to repay it in a punctual styles. For the majority readvanceable mortgages, the degree of rotating borrowing open to people through their HELOC develops instantly while they lower the principal of their amortized mortgage account, and that rotating borrowing stays offered indefinitely.

Furthermore, the fresh new fast rise in domestic cost in certain areas might have sure particular people who HELOC payment tips try a lot of, because the guarantee gains that will originate from future rates payday loans online same day Centre grows would be offered to pay back the principal after they offer their family. Footnote thirteen All the lenders examined did not directly track how long they got borrowers to fully reimburse its HELOC, however, individuals who did revealed that the massive most HELOCs just weren’t fully paid through to the user offered their house.

At once when ?ndividuals are holding number levels of debt, the hard work from HELOC debt may lay further strain on the monetary well-being from Canadian property. Highest amounts of unsecured debt helps it be more challenging for family to manage unforeseen existence incidents like a loss of earnings otherwise unexpected costs. The fresh new stretched users hold financial obligation burdens, the better the probability that they will struggle regardless if off a poor macroeconomic knowledge (elizabeth.g., oils price wonder, monetary credit crunch or interest rate hike).

4.3. Wealth erosion

This new exchangeability and simple entry to home security developed by HELOCs can adversely affect the feature of a few middle-class family to save cash and you will gradually gather wide range. Paying down the mortgage towards the home is a vital part of the average household’s advancing years strategy. Old-fashioned mortgage loans work since pushed discounts automobile. While making regular principal and you will notice repayments to the amortized mortgage loans allows household to slowly collect alot more collateral in their home over the movement of the performing life. Homeloan payment is a really extremely important savings auto towards average middle-category nearest and dearest in the Canada, as their money is focused in the casing assets and their monetary holdings within old age become restricted. Footnote fourteen